Your pension will be registered as a self-administered pension scheme (SSAS), which is where an company can set up a pension scheme for it’s directors. Therefore, to set up a SSAS with Retirement Capital, you must be a director of a limited company and this must be verifiable at Companies House as a trading business. We cannot accept dormant businesses or new start-ups that are not trading.

We are for business owners who want more control and choice over how their pension is invested.

With Retirement Capital, you are connected into the right partnership for your wealth creation success story. 30 years combined experience has gone into the development of a ground breaking pension product that is both innovative and risk based in it’s approach to protect you and us. We are ISO ceritifed across business lines and are accredited for our services.

We rigorously check the identity of all SSAS customers, and all directors being enrolled into the pension to combat identity fraud. We also have strict security on the app to ensure people are unable to access your information. We have joined up with Yoti for identity verification, who are the 1st Government approved digital ID provider.

Our ICO registration number is ZA743823 and you can view our certificate on the ICO Website. We ensure that we handle your data securely and comply with all GDPR laws.

Contributions you make into your SSAS will be eligible for tax relief. If you are a business, you will get a tax deduction as an allowable business expenses.

If you pay in personally and are a basic rate taxpayer, you will get a 20% top up. That means for every £80 net of basic rate you pay into your pension, HMRC adds £20 into your pension! Those on a higher tax band will be able to claim addition tax relief through their tax return.

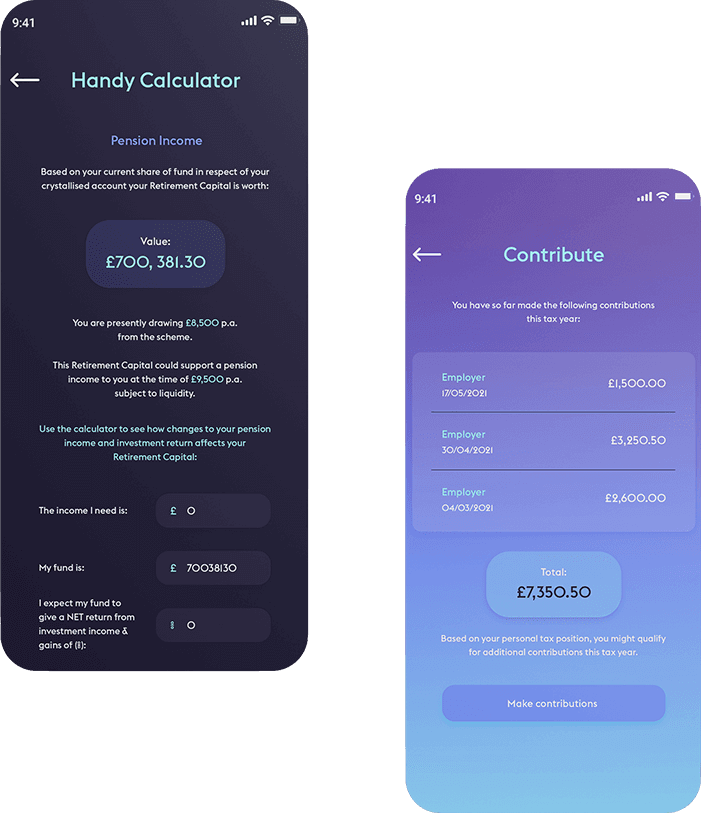

Our handy Retirement Capital tax calculators will be able to work out exactly what you’re going to get back so you can keep your contributions in check.